At times like this, when it can feel like there is much doom and gloom in the news, it is worth taking a step back to gain a little perspective.

For most investors the accumulation of wealth is a slow process as money is put aside month-on-month into pensions and ISAs, inheritances are invested, or the proceeds of company sales are put to work in the markets. This multiple decade journey to a level of wealth that provides choice, freedom, and financial security, is punctuated by moments of market turmoil that lead to temporary falls in portfolio values. When accumulating wealth, such falls provide the opportunity to buy equities at lower prices and with higher expected returns. Income from employment provides a sense of security and, for some, surplus cash flow to accelerate contributions to the pot. Alternatively, options remain for some to retire later, or to work part time.

When workplace income stops, and portfolios take over the role of providing cashflow to fund lifestyles, it is entirely understandable that falls in portfolio values may make some investors feel a little bit uncomfortable. No one really wants to go back to work, curb their plans or – in extremis – risk running out of money. It is helpful to remember that as part of the financial planning process, the financial capacity to suffer losses is modelled to test the suitability of the portfolio chosen to meet a client’s goal with a high degree of confidence. Regular meetings with advisers also provide updates on how the plan is evolving against its target and the opportunity to talk through any areas of concern and, if necessary, to make informed choices to ensure the plan stays on course. As part of this analysis, financial planners will be fully aware that investing is a three-steps-forward, one-step-back type of process and will strive to help clients to understand the nature of the journey they face. However, when markets fall, much of this can be momentarily forgotten. There will be times when portfolio returns are well ahead of inflation, and others when they are not, as the chart below illustrates for a 60% global equity, 40% short-dated global bond example[1].

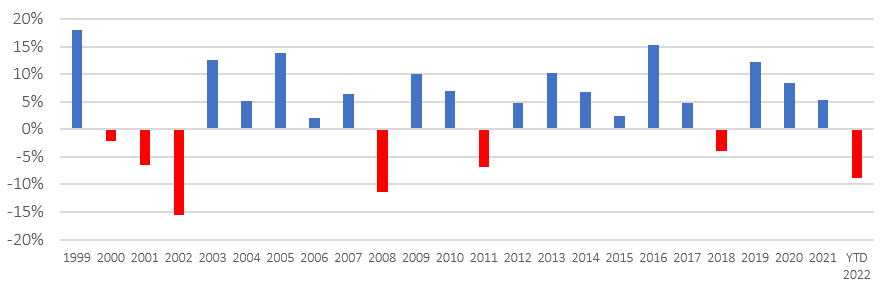

Figure 1: Calendar year, after inflation returns plus YTD 30 April 2022 (latest CPI data)

Source: Morningstar Direct © All rights reserved (see endnote for full details).

[1] As represented by 60% MSCI ACWI (net div., GBP) index 40% FTSE WGBI 1-5 REAL. No costs deducted.

The first point of note is that despite all of the bad news, portfolio returns in 2022 are not as bad as some might have imagined, helped by broad diversification and, to some extent, by the weakness of Sterling (overseas assets are now worth more priced in Sterling terms). Outcomes in 2022 still sit well within expectation. In fact, a 60% global equity, 40% global bond portfolio could fall by 30% or more and still be within the bounds of expectation.

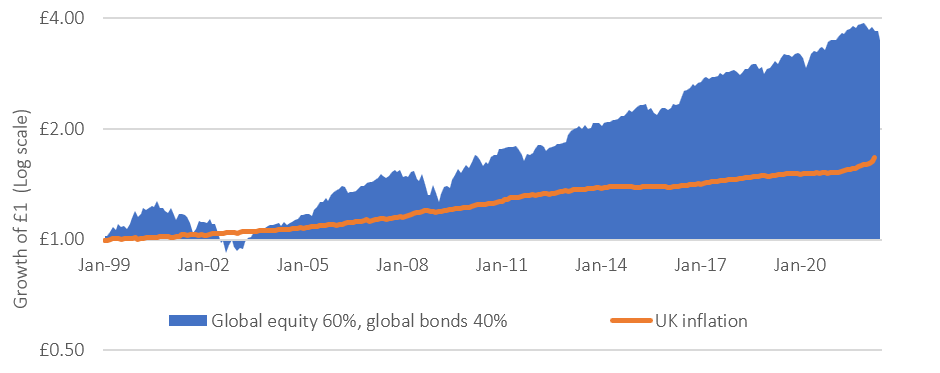

The chart below plots the returns of such a portfolio (the same structure as above) but before inflation. It also plots the cumulative UK CPI inflation index for comparison. Inevitably there will be times when portfolios deliver returns below inflation, but over time, the purchasing power of wealth is expected to grow. A log scale is used on the vertical axis, which effectively plots portfolio rises and falls so comparable movements have the same visual magnitude. Despite the market setbacks of 2000-2003, 2007-2009, Covid in 2020 and today’s market reversal, the purchasing power of invested wealth has grown considerably.

Figure 2: Growth of £1 compared to inflation

Source: Morningstar Direct © All rights reserved (see endnote for full details).

It is helpful at times like these to remember that the process of spending wealth in retirement is a slow process too, similar to its accumulation. Imagine that the withdrawal rate from a portfolio is 3% of its starting value per year adjusted for inflation (i.e. £30,000 on an initial £1 million invested). A couple of years of returns below inflation, is going to make very little impact on portfolio outcomes over a 20- or 30-year (or more) retirement horizon. There should be plenty of years ahead when portfolio returns will be above inflation, although there are no guarantees. Even if there are not, the annual planning process will provide the opportunity to adjust future plans in a calm and informed manner. Those who have been invested over the past few years will already have accumulated strong growth in the purchasing power of their portfolios, providing a solid financial buffer against times like these.

Investors are well served by measuring the value of their wealth against their long-term plan, not against the latest high-water mark of the markets. Portfolio values are still materially above where they were a couple of years ago, even when measured from pre-Covid levels in 2020, as the chart above clearly shows. A recent piece of research[2] also reveals that on average (as ever, no guarantee), returns following market falls tend to be quite strong, historically delivering a cumulative 50% rise in value over the subsequent five years in the US after a 30% fall. Investing is a slow process that cannot be rushed. Take it slowly.

[2] https://my.dimensional.com/three-crucial-lessons-for-weathering-the-stock-markets-storm

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data.

© Morningstar 2021. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted, or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.