There are many good reasons to consider investing, from building up a deposit to buy a home to saving for a comfortable retirement.

If you’re looking to begin investing, here are a few simple factors to consider if want to achieve your investment goals whilst minimising your risks.

Know what your goals are

Before you begin investing, you should always consider what your goals are. What are you investing for?

There are lots of reasons to invest, from building up a rainy-day fund to making sure you can live the lifestyle you want when you retire. Knowing exactly what your goals are will inform your financial plan and help you establish the best ways of investing to meet those goals.

Keep your time horizon in mind to understand risk levels and returns

When trying to choose how much risk you’re willing to take with your investments, keeping your time horizon in mind is important.

A time horizon is how long you expect to invest for to reach your goal. Typically, investments with higher reward potential also come with higher risk attached. This means they can potentially suffer losses before they recover.

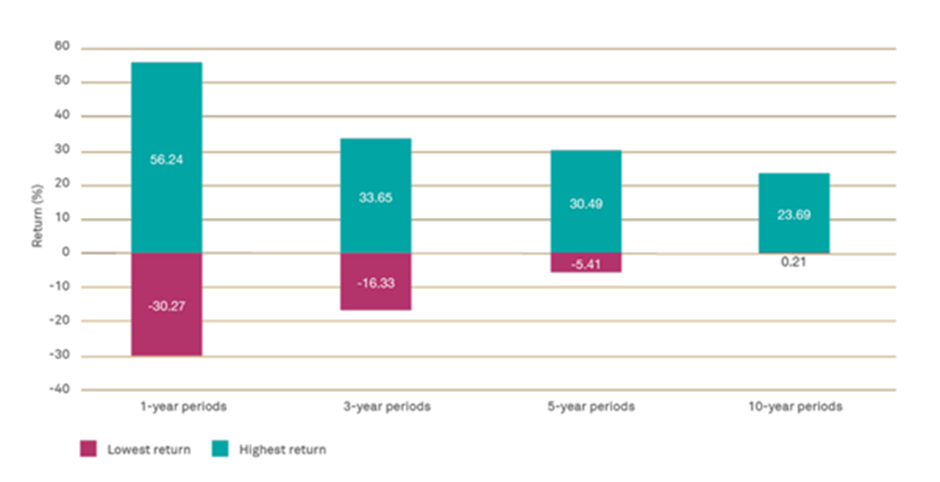

This can be seen in the data from the MSCI World Index, a basket of more than 1,600 large and mid-sized companies across 23 developed countries, since 1970.

The index shows that the highest annual return of a short-term investment (for one year) was 56% whilst the lowest was a fall of 30%. For long-term investments (for over ten years), the highest return was 24% but the lowest was only 0.21%.

As you can see, the risks of long-term investing are significantly lower than those of short-term investing. Investors with a longer time horizon are therefore more able to ride out difficult periods in the stock market and can afford to take more risks with their money.

For example, if you are considering any sort of investment with risk attached, you typically need to be prepared to invest for five years or more.

Diversify your investments to protect your portfolio

It’s a common beginner’s mistake to think that you should only invest in one asset class, for example only buying stocks and shares. This, however, will leave your investment open to risk if that market takes a drop.

A much more sensible way is to diversify between several asset classes.

Diversifying your assets means that, if any particular asset class takes a fall, only part of your investment is affected, whilst the other assets might see growth.

Having a diverse set of investments is important if you want to mitigate the risks.

Try to minimise the impact of charges on your investment

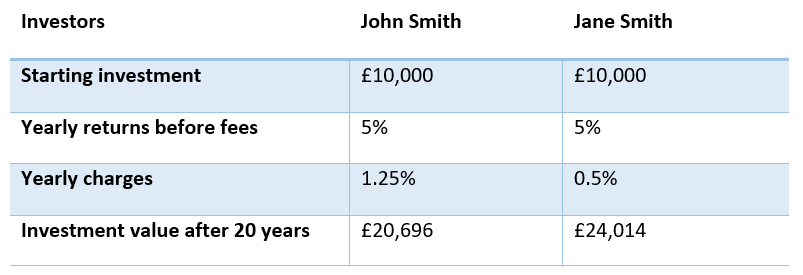

When you invest, you generally pay a charge for fund management. Typically, the fund manager will charge a percentage of the amount you invest. You need to ensure that the charges you pay offer value for money and understand how the charge will affect the future value of the investment.

For example, below is a table comparing two investors. Both have invested the same amount of money but the charges on their investments are different.

As you can see, although the difference in their fees is less than one percent, it has made a significant impact on their overall return.

Decide whether passive or active investments are right for you

There are two main types of investing: active investing and passive investing.

- Active investing usually involves hiring a fund manager to look after your investment. The manager will buy and sell shares in an attempt to improve returns. The manager aims to outperform the market compared to a specific benchmark.

- Passive investing involves minimal trading and does not usually have a manager. The aim of passive investing is to match the returns of a particular market index or benchmark – for example, the FTSE 100 index.

If you want to know more about whether active or passive investing is right for you, speak to a financial adviser. They can help you to decide which strategy might be more helpful to reach your investment goals.

Review your investments at least once a year

If you want to maximise the returns on your investments, it is important to regularly review them.

Regular reviews will allow you to see how they are performing and whether they are likely to achieve your investment goal. They will also allow you to establish whether your investments are sufficiently diversified.

Regular reviews can also be useful to see if your attitude to risk has changed, meaning you might now be more willing to invest in a market with higher returns.

Consider a Stocks and Shares ISA

If you’re just getting started in investing and are unsure where to begin, a simple option is a Stocks and Shares ISA. This is one of the UK’s most popular types of investment, with more than £330 billion invested as of 2020.

In the 2020/21 tax year, you can save up to £20,000 in an ISA. An ISA offers a tax-efficient way to invest your money, with your cash invested in things such as shares, government bonds, and corporate bonds.

Many ISA providers offer an investor a wide range of potential investment choices, letting you diversify your assets however you choose.

If you’re interested in opening a Stocks and Shares ISA, you can find more information online from any ISA provider. However, if you want to make the most of your investment, it may be useful to take advice from a financial adviser.

Please note: The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.