For many investors, the purpose of accumulating wealth in a portfolio is to provide an income either now or in the future that is, at the very least, able to cover their basic needs and hopefully a bit more. The level of portfolio-derived income required is unique to each investor. Some will have pensions related to final salary and possibly other income from other sources, such as property. Others will need to rely more fully on their portfolios. Portfolio income comes from the natural yield that a portfolio throws off in the form of dividends from companies and bond coupons (interest payments), with capital making up any shortfall.

When markets rise, as they have done most years since the Global Financial Crisis a decade ago, portfolios may even grow after an income has been taken, although this will not always be the case. Happy days! When markets fall, it can begin to feel a little uncomfortable as dividends may be cut and equity values may be down materially, as we have seen in the first quarter of 2020 (the upturn in April has helped a little).

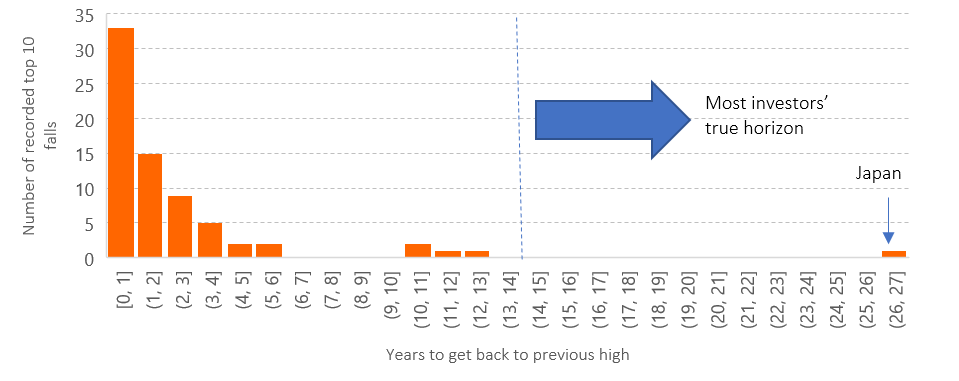

The cardinal sin at these times is to sell equities when they are down and turn falls into losses. To avoid doing this, income required above a portfolio’s natural yield can be taken from bonds or cash reserves. The astute reader’s first question might be ‘How long might I have to do this for?’. The figure below, helps to answer that question. It uses a range of regional (Europe, Asia-Pacific ex-Japan, Emerging and World) and major individual equity markets (US, UK, Japan) and plots the top 10 largest market falls for each and the time taken to recover back to the previous high, in before-inflation terms. Some overlaps obviously occur (e.g. the US is a material part of the World), but broad insights can be gleaned: most market falls recover within 5-6 years, some may take up to a decade or so, and outliers can and do occur, such as Japan which took 27 years to recover (in GBP terms) from its market high in 1989.

Figure 1: How long will you have to wait?

Data source: Morningstar Direct © All rights reserved.

What is also evident is that – with the exception of Japan – these market falls all sat well within most clients’ investment horizons. Whilst Japan provides a salutary lesson that investing outcomes are uncertain, widely diversified portfolios help to mitigate country-specific risks. Even investors in their 80s should be planning to live to at least 100, giving them a 20-year investment horizon (today an 80-year-old woman has a 1-in-10 chance of reaching 98).

The question of how much cash or bonds an investor should hold will vary depending on how important it is for them to meet their basic income needs and how important having more discretionary spending is. Using a sensible multiple of basic annual spending, and possibly additional discretionary spending is a sensible starting point from which to reach a suitable minimum. For those to whom certainty of income is critical, this could be significantly higher and for those to whom it is less critical, it may be lower. For all, it should be sufficient to ensure that they can sit out market any market fall relatively comfortably, without having to sell down equity positions.

Waiting is not so bad when you know how long the wait might be and you come well prepared to sit it out!

Please note

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily Gem & Co Financial Services and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.