Early in September, the FTSE 100 reached its highest level since December 1999. People might read into this story that it’s taken 14 years for the market to recover from the tech crash and the credit crisis and that stock-market investment has been pointless over that period.

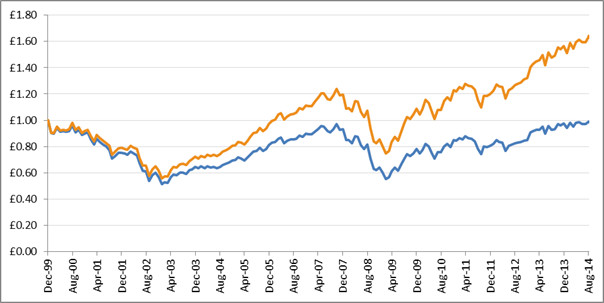

Looking at the blue line on the chart below (the simple price index that you hear quoted in the news) you might think they are right. But that is only part of the story. In fact, it has been quite easy to make money on your investments since the turn of the century by remembering a few simple principles.

First, that the value of dividends and how they compound over time is significant. Reinvested dividends are the difference between the blue and orange lines on the chart. While the simple index has just broken even, an investor who reinvested their dividends would have made around 60 per cent since 1999.

The growth of £1 invested in the FTSE 100 price index (blue) and FTSE 100 total return index (orange) since December 1999. Source: Dimensional.

Next, remember that there is more to a market than the index you hear quoted on the news. The FTSE 100 is just the largest 100 companies listed in London and, as such, is not representative of the UK market (that would be the FTSE All Share) or the UK economy (that would be GDP). The FTSE 100 excludes hundreds of smaller companies, many of which will perform better than the giants of the London market over the long-term.

A sensible long-term investment strategy has little to do with the daily quoted indices that dominate news reporting. That strategy would be globally diversified and take into account a detailed assessment of your future financial needs.

We work hard to devise those sensible long-term investment strategies for you and recognise that, in isolation, the FTSE 100’s current level is little more than a single point of fairly meaningless data.