A straightforward way for an investor to partake in capital markets is to own a diversified basket of stocks of companies from around the world, which can be achieved by owning a global equity fund. Perhaps a global market index tracker.

These days, this can be done cheaply and with ease. Consider this quote from Eugene Fama, often called the father of modern finance:

You have to talk yourself out of the market portfolio

Eugene Fama, speaking with The Rational Reminder Podcast, May 2020

This gives us a sensible starting point for building a portfolio. There are, however, a number of great reasons to talk oneself out of the market portfolio. All of these reasons are – as should always be the case – backed by a deep foundation of evidence.

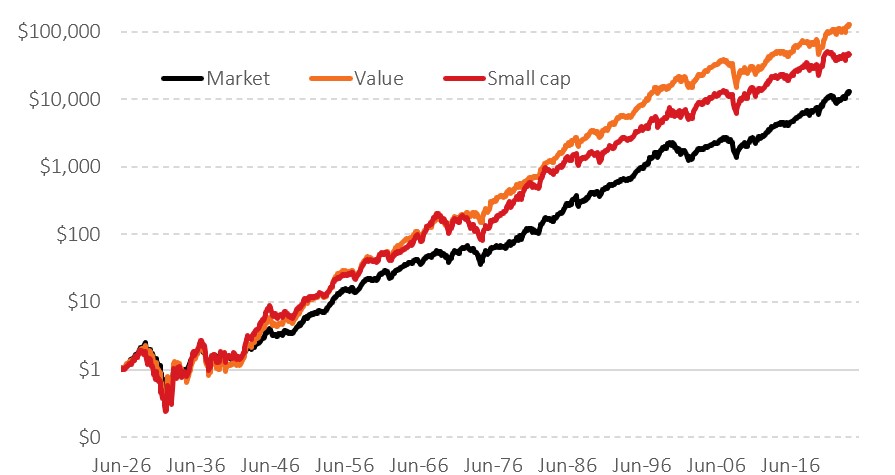

Decades of evidence suggest that groups of companies with certain characteristics exhibit different returns, as a whole, to the market. The difference in returns can be explained by the different risks inherent in these groups of companies. Examples include value[1] and smaller companies[2], or ‘small caps’.

The reason for holding exposures – or ‘tilts’ – to such companies is twofold.

1. Increase expected returns

On the basis of the higher risks involved with owning stocks in companies classed as value or small cap, it is reasonable to expect higher returns over the long term. This is – like most things in investing – by no means a guarantee. However, the longer an investor holds such portfolio exposures the greater the chance they have to enjoy the long term expected outcomes.

Figure 1: The opportunity for higher returns in value and small caps

Data source: Dimensional Returns Web. Jul-26 to May-24. Data in USD. Market: Fama/French Total US Market Research Index, Value: Fama/French US Value Research Index, Small cap: Fama/French US Small Cap Research Index

Data source: Dimensional Returns Web. Jul-26 to May-24. Data in USD. Market: Fama/French Total US Market Research Index, Value: Fama/French US Value Research Index, Small cap: Fama/French US Small Cap Research Index

Over the same period as that in the figure above, a portfolio[3] with moderate tilts to value and small caps enjoyed an annualised excess return of 1% over that of the broad stock market. For investors, this is an opportunity to increase the chance of achieving investing success and, ultimately, meeting one’s financial goals.

The expected outperformance of a tilted portfolio, however, is not delivered with regularity. There can be times whereby such exposures can leave an investor lagging the performance of the market. It could, perhaps, result in deeper declines in the short term in market downturns. The worst over the period above happened between Apr-37 and Mar-38, when the US market was down -49% and the tilted portfolio a further -7%. Investors with the patience and fortitude to continue with a disciplined approach of buying, holding and rebalancing during such times are rewarded in the long term.

2. Improve diversification

Another important benefit of moving away from the portfolio and tilting to value and smaller companies is improved diversification. In investing-jargon, this is owning exposures to imperfectly correlated asset classes. This can result in better ‘worst case’ outcomes, which is an important concern for any investor.

Figure 2: Worst month-to-month return outcomes over different periods

Data source: Dimensional Returns Web. Jul-26 to May-24. Data in USD and in cumulative terms. Market: Fama/French Total US Market Research Index, Value: Fama/French US Value Research Index, Small cap: Fama/French US Small Cap Research Index

In global markets, the largest five companies comprise 17% of the market[4], at time of writing. Owning a tilted portfolio[5] reduces this to 10%. For investors, this means lowering the concentration in a small number of companies, whilst still enjoying the returns such companies offer to investors as the largest in the world.

Have confidence in the approach

Investors should take comfort in the fact that they own a well-structured solution, grounded in evidence, built with an aim to deliver better outcomes. For many, owning short-dated bonds or cash also helps to smooth the investing journey.

When it comes to the growth engine of an investment solution, starting with the market portfolio is sensible. Moving away from this – with the guidance of a solid foundation of evidence – makes good sense. The difficult job an investor has – for which your adviser is always there to support you with – is to maintain confidence in their approach through time, whilst not concentrating too much on short-term outcomes.

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] A value stock is a company whose price is cheap relative to some metric – or ‘fundamental’ – that relates to the firm. This ‘fundamental’ could be its book value, earnings, sales, dividends, cash flow or some other measure. The opposite of value is ‘growth’ where the price is high relative to the metric chosen. Empirical research suggests that value stocks across global markets have offered a premium, on average, relative to growth stocks, in return for taking on a higher level of financial risk associated with them.

[2] Smaller company stocks are those whose size, as defined by market capitalisation – the price of each share times the number of shares – is smaller than other stocks in the market. A commonly used definition of ‘small cap’ is the bottom 10% of stocks by market capitalisation. Empirical research suggests that globally, smaller companies have offered outperformance relative to larger companies, perhaps on account of their higher risks.

[3] 60% US market, 20% US value, 20% US small cap, rebalanced annually. Indices used same as those in figure 1.

[4] Data source: iShares MSCI ACWI ETF, ishares.com. Accessed 31/07/2024. Not a recommendation.

[5] 60% iShares MSCI ACWI ETF, 20% Dimensional Global Value Fund, 20% Vanguard Global Small-Cap. Not a recommendation.